SOFR PAI: One step less! One more arbitrage?

LCH has announced that it will merge two steps in the long five step process transition from EFFR to SOFR.

The transition as described by the ARRC included a step (Step 4) where CCP would offer the option to trade (USD) swaps with either EFFR or SOFR PAI (at the member choice). With the EFFR version available only to reduce the exiting exposure. The last step would have been to accept only SOFR collateralised trades and to transfer the remaining trades from EFFR to SOFR collateral.

The announced decision that will take effect in 2020 (no precise date yet) will merge those two steps. LCH will use SOFR PAI for all new trades and at the same time transfer all existing (USD) trades from EFFR to SOFR PAI. My understanding is that the existing OIS indexed on EFFR will stay on EFFR for coupon computation purposes but move to SOFR for PAI (and the associated collateral valuation).

A value transfer compensation (positive or negative) will be paid to all members and clients for this change. The exact mechanism for the value transfer computation has not been designed yet.

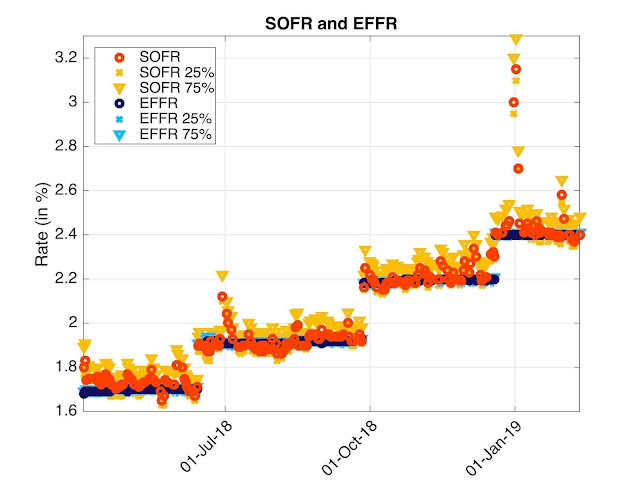

This will be a challenging issue if you want to do it well. There is a basis between SOFR and EFFR. The OIS basis has been between -1 and -3 basis points in the last months (SOFR-1bps V EFFR). But this is a basis for trades on a fixed tenor on full months or years (e.g. 3-month or 2-year). This benign basis does to translate to a benign basis on a daily basis. There is large intra month fluctuation on the fixing spreads. The EFFR are almost constant between FOMC decision while SOFR vary widely as depicted in the graph below.

The spread SOFR - EFFR since the first publication of SOFR on 2 April 2018 has been between -5 basis points and 75 basis points (around year end). There is also a clear seasonality of the spread. At every month end and around 15 of the month, the SOFR increases while EFFR is unchanged. It would be very easy to take advantage of those seasonality to design money making strategies. They would be of a different nature than the one on LIBOR fallback that I described recently (see Still Making Money on LIBOR fallback). You would not even need to trade strange dates OIS with one counterparty, just trade vanilla LIBOR swaps in the right way with different counterparties (potentially on different dates). Maybe the gain is not enough to pay for the full bid-offer on new trades, but in a market-making activity with flows around mid, it is worth taking those issues into account. Don't hesitate to contact me to know about those strategies; advisory services available!

Personally I would prefer to have some "dual discounting" period. That would allow people to trade out of EFFR PAI at the level they can find in the market and that seems fair to them. Forcing an arbitrary value transfer mechanism on the participants may create value transfer from the parties better informed on the intricacies of valuation mechanisms to the less informed ones.

Risk magazine article on the subject (subscription required): LCH plans 2020 switch to SOFR discounting

The transition as described by the ARRC included a step (Step 4) where CCP would offer the option to trade (USD) swaps with either EFFR or SOFR PAI (at the member choice). With the EFFR version available only to reduce the exiting exposure. The last step would have been to accept only SOFR collateralised trades and to transfer the remaining trades from EFFR to SOFR collateral.

The announced decision that will take effect in 2020 (no precise date yet) will merge those two steps. LCH will use SOFR PAI for all new trades and at the same time transfer all existing (USD) trades from EFFR to SOFR PAI. My understanding is that the existing OIS indexed on EFFR will stay on EFFR for coupon computation purposes but move to SOFR for PAI (and the associated collateral valuation).

A value transfer compensation (positive or negative) will be paid to all members and clients for this change. The exact mechanism for the value transfer computation has not been designed yet.

This will be a challenging issue if you want to do it well. There is a basis between SOFR and EFFR. The OIS basis has been between -1 and -3 basis points in the last months (SOFR-1bps V EFFR). But this is a basis for trades on a fixed tenor on full months or years (e.g. 3-month or 2-year). This benign basis does to translate to a benign basis on a daily basis. There is large intra month fluctuation on the fixing spreads. The EFFR are almost constant between FOMC decision while SOFR vary widely as depicted in the graph below.

Historical data of EFFR and SOFR since 2 April 2018. Data source: Federal Reserve Bank of New York.

The spread SOFR - EFFR since the first publication of SOFR on 2 April 2018 has been between -5 basis points and 75 basis points (around year end). There is also a clear seasonality of the spread. At every month end and around 15 of the month, the SOFR increases while EFFR is unchanged. It would be very easy to take advantage of those seasonality to design money making strategies. They would be of a different nature than the one on LIBOR fallback that I described recently (see Still Making Money on LIBOR fallback). You would not even need to trade strange dates OIS with one counterparty, just trade vanilla LIBOR swaps in the right way with different counterparties (potentially on different dates). Maybe the gain is not enough to pay for the full bid-offer on new trades, but in a market-making activity with flows around mid, it is worth taking those issues into account. Don't hesitate to contact me to know about those strategies; advisory services available!

Personally I would prefer to have some "dual discounting" period. That would allow people to trade out of EFFR PAI at the level they can find in the market and that seems fair to them. Forcing an arbitrary value transfer mechanism on the participants may create value transfer from the parties better informed on the intricacies of valuation mechanisms to the less informed ones.

Risk magazine article on the subject (subscription required): LCH plans 2020 switch to SOFR discounting

Comments

Post a Comment