Are LIBOR swaps still representing Interbank credit risk?

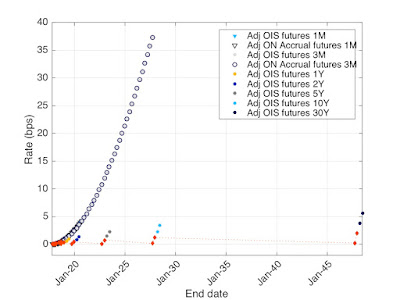

The letters " IB " in LIBOR stand for InterBank . The LIBOR fixings are suppose to represent the rate in the interbank market, with its pure interest rate component and its credit risk component. The spread between the LIBOR of a given tenor and the OIS rate for the same tenor can be viewed as a proxy for the credit quality of banks. In the August to October period, the spread GBP-LIBOR-6M/OIS-SONIA-6M has been between 17 and 19 basis points. From the end of October to today, the spread has increase from 19 basis points to 30 basis points. On the 3M side, the spread had been between 9 and 11 basis points and increased from 11 to 20 basis point in the same two-month period. In the same period the stock market was tumbling (the FTSE 100 lost more than 10% in the same period) and CDS indices spiking. That make sense as there is a high correlation between low stock prices, high credit spreads and higher default rate. But what happened to the basis spread for 30Y-tenor swaps LIBO