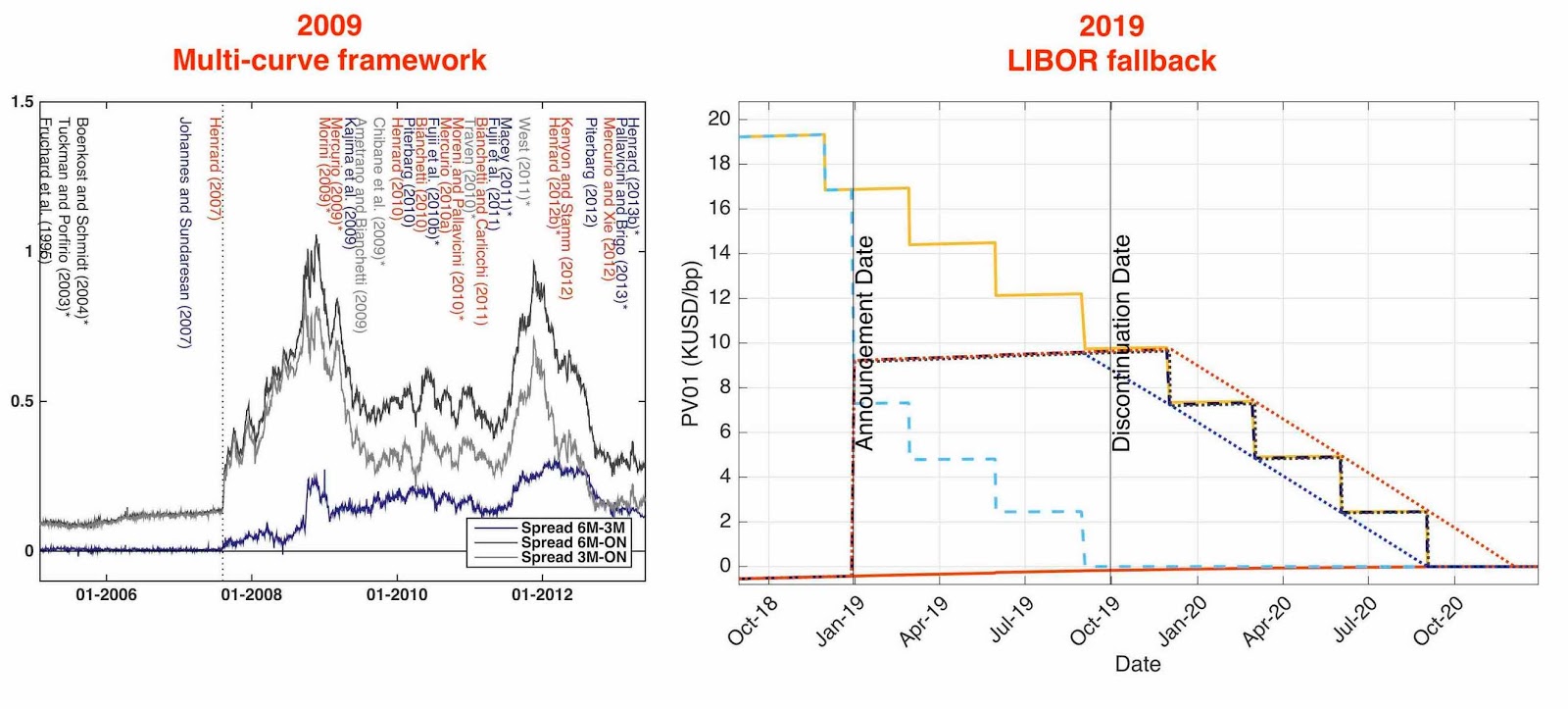

An update on my basis position inspired by fallback expected spread adjustment fallback procedure and value transfer. I took the position one month ago (29-Nov) on a basis swap where I pay LIBOR-1M v receive SONIA + spread on a 30-year tenor for a notional of 1m. The spread of the trade was at 13.45 bps. First an update on the different spreads (as of Monday 31 December), with in order, the figures before the announcement, the analysis predictions, the figures on the date I took the position and the figures today Name Announcement Prediction Position Today Libor 3M - SONIA 22.50 9 to 18 19.65 18.05 Libor 6M - Libor 3M 5.90 8 to 16 7.60 7.80 Libor 6M - Libor 1M 12.20 14 to 25 13.80 13.60 In all cases the spreads continue to move in the direction predicted by the analysis. For my position, the spread converge slowly but surely to the expected res...