Risk-based overnight-linked futures

Some years ago I proposed an innovative design for risk-based swap futures.

I worked with ASX to adapt it to the AUD BBSW swap market and a product based on that design has been traded on the exchange since 2016 (even if it has not attracted a lot of trading activity).

With the new importance of overnight benchmarks, the ETD market has to find a product that could be used for price discovery and risk management of the full term structure of interest rate.

I have detailed a version of the generic futures design to match the overnight conventions and OTC markets. The product has been presented to the main interest rate futures exchanges in Europe and the USA. We will see if it takes a new life.

The technical details are now available in the form of a note. The document can be downloaded from SSRN at https://ssrn.com/abstract=3238640.

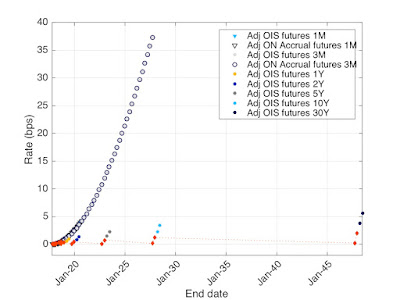

In the graph below I have displayed the convexity adjustments between the ETD futures and the OTC swaps that can be obtained with this design (in red) and the ones with the current design of overnight-linked futures. See the paper for the exact description of the graph.

I worked with ASX to adapt it to the AUD BBSW swap market and a product based on that design has been traded on the exchange since 2016 (even if it has not attracted a lot of trading activity).

With the new importance of overnight benchmarks, the ETD market has to find a product that could be used for price discovery and risk management of the full term structure of interest rate.

I have detailed a version of the generic futures design to match the overnight conventions and OTC markets. The product has been presented to the main interest rate futures exchanges in Europe and the USA. We will see if it takes a new life.

The technical details are now available in the form of a note. The document can be downloaded from SSRN at https://ssrn.com/abstract=3238640.

In the graph below I have displayed the convexity adjustments between the ETD futures and the OTC swaps that can be obtained with this design (in red) and the ones with the current design of overnight-linked futures. See the paper for the exact description of the graph.

Comments

Post a Comment