Making money on LIBOR fallback (one year later)

At the end of November 2018, I took a GBP (paper) position on my view that LIBOR fallback approach will allow better informed participants to make money (transfer value from) the end-users. I have reported on a regular basis about that position in the first six months (see list of episode at the post bottom). One year later, what happen to that view and to my position?

I'm happy to report that Saint Nicolas brought me a very nice present (Saint Nicolas is an important day in Belgium for good kids like me ;)).

On 29 November 2018, I wrote

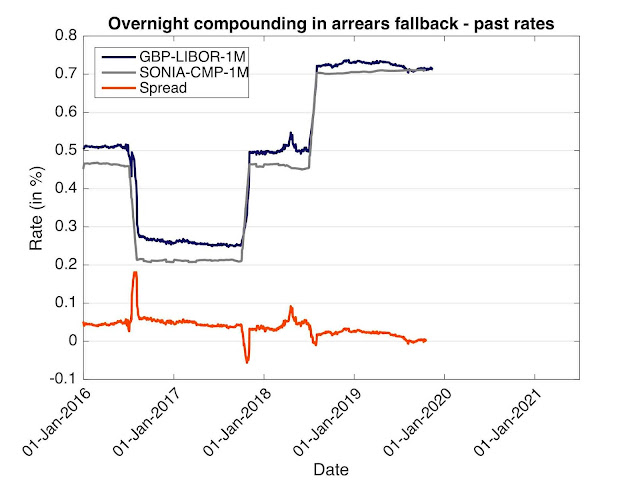

Where do I stand today? According to my figures, in term of spread convergence, the spread has decrease by 4.5 basis points (my target was 5 bps). That makes a profit of roughly 9,000 GBP. On the carry side, I was more lucky than skilful, the spread was well above my expectation. According to my computation, the realised spread has been around 9.5 bps. For the month of September, the LIBOR/SONIA spread was even negative by 0.4 bps. Remember LIBOR is forward looking and SONIA backward looking, explaining why negative spreads are nothing extraordinary. The graph of the realised GBP-LIBOR-1M and SONIA in arrears is proposed below. You can see the current vey low spread and the regular appearance of negative spreads. The cumulative (realised) carry over the last 12 months for my position is around 960 GBP.

Not a bad profit for a low risk (to my view) position: almost 10,000 GBP for a 1,000,000 notional.

Over the last year, ISDA has published several consultations, including the final consultation on the spread. There are still many details to be clarified (see my post on the consultation results) but we have a good idea of the spread level.

Here again I have been lucky! The consultation has decided (against my opinion) to use a median spread with a 5-year look-back period, i.e. the respondents (mainly banks) have decided to use a low spread. To my estimate, this means another couple of basis points to go in the market basis spread. The current realised spread is very low, which means realised carry. The graph of the 30-year tenor basis spread and my computed estimate of the median is provided below.

Because I like the position (bad reason to keep a position, you should have rational, not emotional arguments for a position), I leave it open a little bit more. But this time, I promise, I will close it as soon as my profit reaches 6 bps.

Previous episodes:

I'm happy to report that Saint Nicolas brought me a very nice present (Saint Nicolas is an important day in Belgium for good kids like me ;)).

On 29 November 2018, I wrote

The horizon for my position is 29-Nov-2019. Target profit is 5bps x ~2000 GBP/bps = ~10,000 GBP. I cut the position on the earliest of when the market has reached 8.5 bps or on 29-Nov-2019. I'm also expecting a little bit of carry as the current level of realised spread (1 to 3 bps) is below the market basis spread.

Where do I stand today? According to my figures, in term of spread convergence, the spread has decrease by 4.5 basis points (my target was 5 bps). That makes a profit of roughly 9,000 GBP. On the carry side, I was more lucky than skilful, the spread was well above my expectation. According to my computation, the realised spread has been around 9.5 bps. For the month of September, the LIBOR/SONIA spread was even negative by 0.4 bps. Remember LIBOR is forward looking and SONIA backward looking, explaining why negative spreads are nothing extraordinary. The graph of the realised GBP-LIBOR-1M and SONIA in arrears is proposed below. You can see the current vey low spread and the regular appearance of negative spreads. The cumulative (realised) carry over the last 12 months for my position is around 960 GBP.

Not a bad profit for a low risk (to my view) position: almost 10,000 GBP for a 1,000,000 notional.

Where do I go from here?

Over the last year, ISDA has published several consultations, including the final consultation on the spread. There are still many details to be clarified (see my post on the consultation results) but we have a good idea of the spread level.

Here again I have been lucky! The consultation has decided (against my opinion) to use a median spread with a 5-year look-back period, i.e. the respondents (mainly banks) have decided to use a low spread. To my estimate, this means another couple of basis points to go in the market basis spread. The current realised spread is very low, which means realised carry. The graph of the 30-year tenor basis spread and my computed estimate of the median is provided below.

Because I like the position (bad reason to keep a position, you should have rational, not emotional arguments for a position), I leave it open a little bit more. But this time, I promise, I will close it as soon as my profit reaches 6 bps.

Previous episodes:

Comments

Post a Comment